What Is The Formula For Calculating Salvage Value . salvage value is the amount that an asset is estimated to be worth at the end of its useful life. Here, p = original cost of the asset, i = depreciation rate, y = number of years. — salvage value formula. Learn how to calculate the salvage value for small. It is also known as scrap value or residual value, and is used when. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. — the asset’s depreciable value is the difference between the purchase price and the salvage value. Subtract the accumulated depreciation from the initial cost to determine the residual value. you can calculate salvage value by knowing the original price, depreciation rate, and the age of the asset. — an asset’s salvage value is used to depreciate the cost on a business’s balance sheet.

from www.chegg.com

Learn how to calculate the salvage value for small. Subtract the accumulated depreciation from the initial cost to determine the residual value. salvage value is the amount that an asset is estimated to be worth at the end of its useful life. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. — salvage value formula. — an asset’s salvage value is used to depreciate the cost on a business’s balance sheet. you can calculate salvage value by knowing the original price, depreciation rate, and the age of the asset. Here, p = original cost of the asset, i = depreciation rate, y = number of years. — the asset’s depreciable value is the difference between the purchase price and the salvage value. It is also known as scrap value or residual value, and is used when.

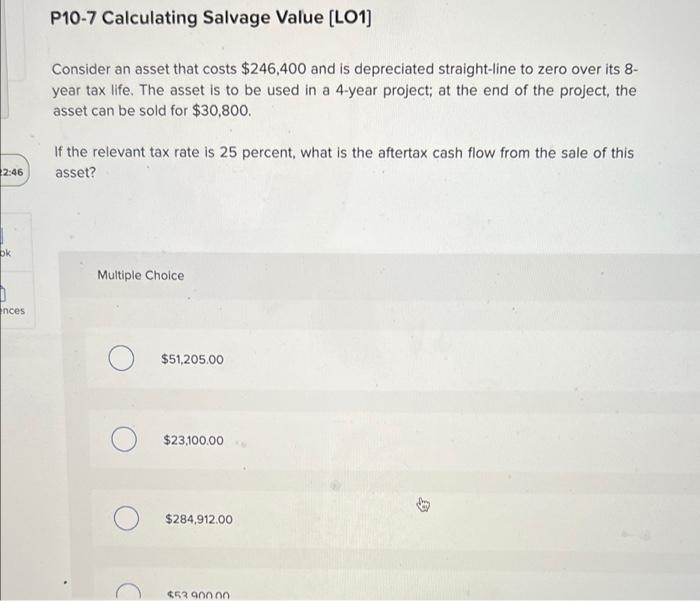

Solved P107 Calculating Salvage Value (LO1) Consider an

What Is The Formula For Calculating Salvage Value Here, p = original cost of the asset, i = depreciation rate, y = number of years. — the asset’s depreciable value is the difference between the purchase price and the salvage value. Subtract the accumulated depreciation from the initial cost to determine the residual value. salvage value is the amount that an asset is estimated to be worth at the end of its useful life. It is also known as scrap value or residual value, and is used when. — salvage value formula. Learn how to calculate the salvage value for small. you can calculate salvage value by knowing the original price, depreciation rate, and the age of the asset. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. Here, p = original cost of the asset, i = depreciation rate, y = number of years. — an asset’s salvage value is used to depreciate the cost on a business’s balance sheet.

From gocodes.com

5 Equipment Depreciation Methods You Need to Know About What Is The Formula For Calculating Salvage Value Here, p = original cost of the asset, i = depreciation rate, y = number of years. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. — an asset’s salvage value is used to depreciate the cost on a business’s balance sheet. It. What Is The Formula For Calculating Salvage Value.

From www.chegg.com

Solved Problem 610 Calculating Salvage Value An asset used What Is The Formula For Calculating Salvage Value you can calculate salvage value by knowing the original price, depreciation rate, and the age of the asset. Learn how to calculate the salvage value for small. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. — an asset’s salvage value is. What Is The Formula For Calculating Salvage Value.

From www.chegg.com

Solved Problem 610 Calculating Salvage Value An asset used What Is The Formula For Calculating Salvage Value Learn how to calculate the salvage value for small. — the asset’s depreciable value is the difference between the purchase price and the salvage value. — an asset’s salvage value is used to depreciate the cost on a business’s balance sheet. Subtract the accumulated depreciation from the initial cost to determine the residual value. — salvage value. What Is The Formula For Calculating Salvage Value.

From www.chegg.com

Solved Calculating aftertax salvage value Excel FILE HOME What Is The Formula For Calculating Salvage Value It is also known as scrap value or residual value, and is used when. — the asset’s depreciable value is the difference between the purchase price and the salvage value. Subtract the accumulated depreciation from the initial cost to determine the residual value. — salvage value is the estimated book value of an asset after depreciation is complete,. What Is The Formula For Calculating Salvage Value.

From exomwwayt.blob.core.windows.net

How To Calculate Salvage Value Of A Car at Terrance Duncan blog What Is The Formula For Calculating Salvage Value — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. Here, p = original cost of the asset, i = depreciation rate, y = number of years. you can calculate salvage value by knowing the original price, depreciation rate, and the age of the. What Is The Formula For Calculating Salvage Value.

From www.youtube.com

Calculating AfterTax Salvage Value YouTube What Is The Formula For Calculating Salvage Value — an asset’s salvage value is used to depreciate the cost on a business’s balance sheet. Learn how to calculate the salvage value for small. salvage value is the amount that an asset is estimated to be worth at the end of its useful life. It is also known as scrap value or residual value, and is used. What Is The Formula For Calculating Salvage Value.

From www.slideshare.net

Salvage Value Calculation What Is The Formula For Calculating Salvage Value — salvage value formula. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. salvage value is the amount that an asset is estimated to be worth at the end of its useful life. Here, p = original cost of the asset, i. What Is The Formula For Calculating Salvage Value.

From haipernews.com

How To Calculate Depreciation With Salvage Value Haiper What Is The Formula For Calculating Salvage Value It is also known as scrap value or residual value, and is used when. Here, p = original cost of the asset, i = depreciation rate, y = number of years. Subtract the accumulated depreciation from the initial cost to determine the residual value. you can calculate salvage value by knowing the original price, depreciation rate, and the age. What Is The Formula For Calculating Salvage Value.

From www.thetechedvocate.org

How to Calculate Salvage Value The Tech Edvocate What Is The Formula For Calculating Salvage Value Subtract the accumulated depreciation from the initial cost to determine the residual value. — an asset’s salvage value is used to depreciate the cost on a business’s balance sheet. salvage value is the amount that an asset is estimated to be worth at the end of its useful life. — salvage value formula. — salvage value. What Is The Formula For Calculating Salvage Value.

From www.damagedcars.com

Salvage Value of Car Calculator What Is The Formula For Calculating Salvage Value — salvage value formula. — the asset’s depreciable value is the difference between the purchase price and the salvage value. It is also known as scrap value or residual value, and is used when. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive. What Is The Formula For Calculating Salvage Value.

From www.deskera.com

Scrap Value Definition, Formula, and Examples What Is The Formula For Calculating Salvage Value Learn how to calculate the salvage value for small. you can calculate salvage value by knowing the original price, depreciation rate, and the age of the asset. It is also known as scrap value or residual value, and is used when. Here, p = original cost of the asset, i = depreciation rate, y = number of years. . What Is The Formula For Calculating Salvage Value.

From www.slideserve.com

PPT Engineering Economics PowerPoint Presentation, free download ID What Is The Formula For Calculating Salvage Value It is also known as scrap value or residual value, and is used when. Here, p = original cost of the asset, i = depreciation rate, y = number of years. — the asset’s depreciable value is the difference between the purchase price and the salvage value. Learn how to calculate the salvage value for small. — salvage. What Is The Formula For Calculating Salvage Value.

From www.chegg.com

Solved Problem 610 Calculating Salvage Value An asset used What Is The Formula For Calculating Salvage Value Subtract the accumulated depreciation from the initial cost to determine the residual value. — salvage value formula. salvage value is the amount that an asset is estimated to be worth at the end of its useful life. — an asset’s salvage value is used to depreciate the cost on a business’s balance sheet. you can calculate. What Is The Formula For Calculating Salvage Value.

From www.slideshare.net

Salvage Value Calculation What Is The Formula For Calculating Salvage Value salvage value is the amount that an asset is estimated to be worth at the end of its useful life. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. — salvage value formula. — the asset’s depreciable value is the difference. What Is The Formula For Calculating Salvage Value.

From www.chegg.com

Solved P107 Calculating Salvage Value (LO1) Consider an What Is The Formula For Calculating Salvage Value salvage value is the amount that an asset is estimated to be worth at the end of its useful life. — salvage value formula. Here, p = original cost of the asset, i = depreciation rate, y = number of years. It is also known as scrap value or residual value, and is used when. you can. What Is The Formula For Calculating Salvage Value.

From www.reddit.com

How to calculate salvage value r/excel What Is The Formula For Calculating Salvage Value Here, p = original cost of the asset, i = depreciation rate, y = number of years. — salvage value formula. salvage value is the amount that an asset is estimated to be worth at the end of its useful life. — salvage value is the estimated book value of an asset after depreciation is complete, based. What Is The Formula For Calculating Salvage Value.

From www.yourmechanic.com

How to Calculate the Value of a Salvaged Car YourMechanic Advice What Is The Formula For Calculating Salvage Value Here, p = original cost of the asset, i = depreciation rate, y = number of years. Learn how to calculate the salvage value for small. — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. It is also known as scrap value or residual. What Is The Formula For Calculating Salvage Value.

From www.educba.com

Salvage Value Examples of Salvage Value Uses and Importance What Is The Formula For Calculating Salvage Value — salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in. Here, p = original cost of the asset, i = depreciation rate, y = number of years. Learn how to calculate the salvage value for small. — the asset’s depreciable value is the difference. What Is The Formula For Calculating Salvage Value.